The Benefits of Digital Onboarding and Origination

Customer onboarding was transformed into a 5-minute experience

With DFA loan turnaround time decreased from 72 to 6 hours. (Accion)

12 to 24 months calculated breakeven for the DFA investment.

DFAs bring a 134% increase in average loan officer caseload, translating to revenue growth

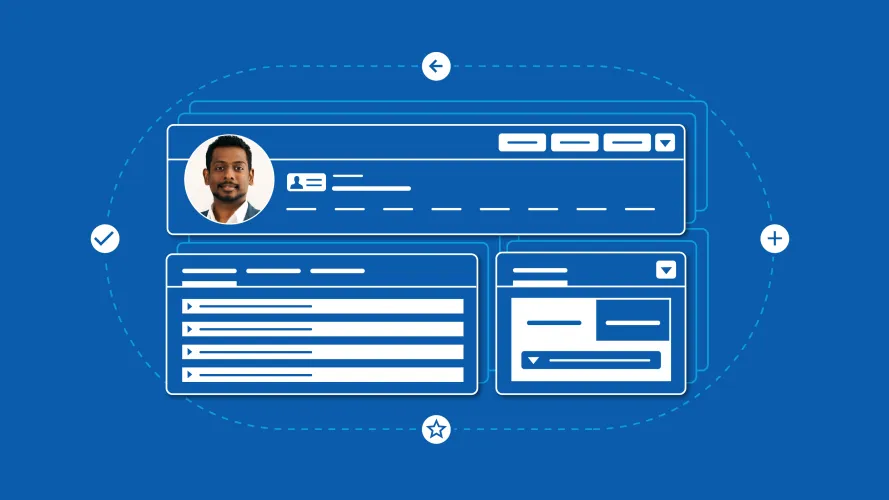

Supercharge Field Services with Digital Efficiency

The digital tools your field officers need for improved productivity and higher portfolio quality.

ACQUIRE CUSTOMERS ANYWHERE

With fast and intuitive mobile customer onboarding and loan origination.

WORK EVEN OFFLINE

Remote, underserved markets with low or no connectivity are one tap away.

REDUCE PAPER, DECREASE COSTS

Accurately capture documents and ID cards, use optional OCR.

EASILY MONITOR AND PLAN TASKS

Track completed and pending tasks, plan day-to-day work to boost team efficiency.

BENEFIT FROM A 360 CUSTOMER VIEW

Focus on building relationship across products.

MAKE BETTER CREDIT DECISIONS

Real-time credit bureau lookups and 3rd-party scoring integration

Grow Channel Revenue

Expand your market at a minimal cost.

Cash Deposit/Withdrawal,

Balance Enquiries

Group

Collection Sheets

Savings and

Current Accounts

Individual and

Group Loans

Offer fast track loans to your best customers and nurture the rest. Lower delinquency risk from the start.

Customize your own or use out-of-the-box workflows. Benefit from multi-level loan decisions, fueled by data

Manage all your digital channels and affiliates from a central portal. Define flexible user roles and permissions.

Easily configure your own forms. Store data on the DigiWave platform or directly in your core banking or other systems.

Easily integrates with your core banking and legacy systems. Embed third-party provider services to enrich your offering.

Manage all your digital channels and affiliates from a central portal. Define flexible user roles and permissions.

ONBOARDING

Onboard in Minutes.

LOAN ORIGINATION

Lower Cost

to Originate.

APPROVAL

Faster Time to Approval.

DISBURSEMENT

Faster Time to Disbursement.

REPAYMENT

Lower

Delinquency

The DFA Solution at a Glance

Combine human interactions with digital efficiency. DFA enables financial institutions to digitize customer onboarding, account opening, loan origination, transactions, and more, even in areas with no connectivity. The results - convenient, efficient and cost-effective services at the customer's doorstep.

Why Choose Business Intelligence Agency ?

DFA is built on DigiBank - Enterprise Digital Banking Platform.

Quick-to-market, scalable implementation with fast positive ROI

Over 10 years of global experience with 200+ customers in over 70+ countries

Clients Growing Their Business with DFA

Get started with digital onboarding and origination.

Deliver financial services anywhere.