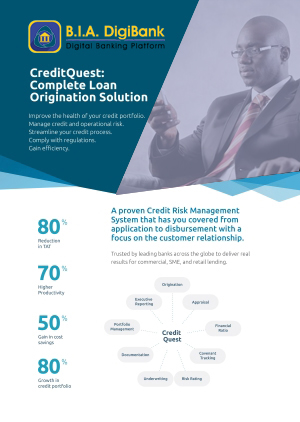

Powerful Credit Risk Management System

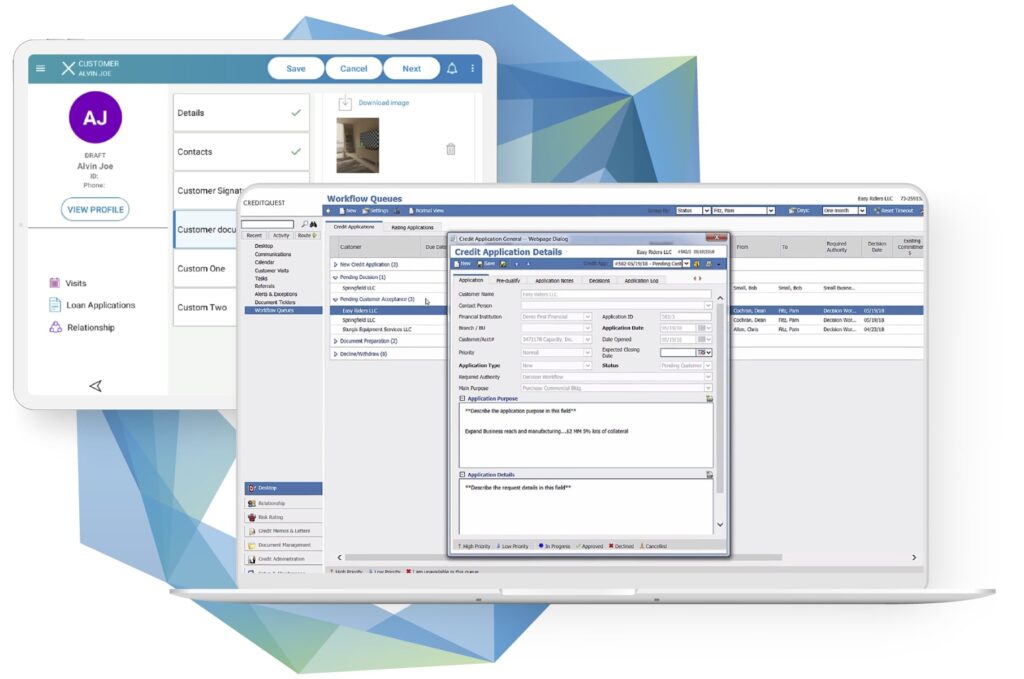

A single loan origination solution that brings real results for bank teams. Trusted by leading organizations across the globe, CreditQuest provides commercial and retail loan origination, risk ratings, advanced analysis, underwriting, documentation, executive reporting, and portfolio management with a focus on the customer relationship.

With standardized workflow, accurate data, collaboration

Real result measured at a CreditQuest client

Increased operational efficiency and profitability

Reduced turnaround time to originate and process a loan

Key Solution Modules at a Glance

Fully-featured, out-of-the-box, configurable to commercial, retail, SME lending

Rating Manager

- Obligor & facility rating (LGD, PD)

- Wide range of rating models

Supercharge the Full Credit Risk Management Lifecycle

Digital Compass for Lenders

Are your credit operations future-proof? Test your digital maturity to see how your level of automation compares to competitors. Discover new growth opportunities with real-time tips to improve your lending business.

Improve Portfolio Growth, Credit Quality & TAT

Optimize and digitize the whole credit process and exceed targets

STREAMLINE CREDIT OPERATIONS

Automate routine tasks and reduce paperwork with a streamlined workflow. Use out-of-the-box capabilities – risk rating models

CONTROL & MANAGE RISK

Control credit risk at the point of origination, upon individual account review, and at the portfolio level.

LEVERAGE A SINGLE PLATFORM

A single platform for all your business lines: SME, commercial, corporate, retail loans.

CreditQuest Solution Overview

The complete loan origination solution by Business intelligence Agency enables relationship managers, credit analysts, credit committees and senior executives make profitable credit decisions faster, achieving double-digit growth through a single platform.

Master Loan Origination Challenges with Real Results

Credit Risk Management

Enforce Credit Policy Mitigate credit & operational risk

Reduce time to approval Improve customer experience & retention

Improve portfolio management reporting Enhance data quality.

Clients Growing Their Lending Business with CreditQuest

Ready to take your lending strategy to the next level?