The Premium Agency Banking Solution

Proven to cater to the needs of the biggest Tier 1 and Tier 2 banks. Agent hierarchies, advanced analytics, multiple devices and thousands of transactions daily supported by our data-driven, enterprise platform.

The Benefits of Agency Banking

Cost of transaction

Using agents can reduce the cost of doing a transaction by about 25 percent compared to branch transactions. (IFC)

Points of sale

Transactions

More savings

The Benefits of Agency Banking

Scale your points of service without investing in costly branch and ATM networks

CUT OPERATIONAL COSTS

OFFER CONVENIENCE

INNOVATE RAPIDLY AND STAY AGILE

Baobab Increased Points of Sale 15 Times with Agency Banking

Forrester Consulting Total Economic Impact™ Study: 369% Three Year ROI from Agency Banking

An independent commissioned study by Forrester Consulting demonstrates the significant cost savings and business benefits enabled by Business Intelligence Agency ’s Agency Banking Solution.

Agent Banking Best Practices Delivered

Leverage on our experience from deploying Agency in more than 15 countries.

Enable Agents to Transact. Watch Your Customer Base & Profits Grow.

Provide a multitude of transactions through agents.

- Customer registration & account opening with secure data capture and Bio, Card or OTP eKYC authentication

- Real-time transactions – cash in/ cash out, transfers, balance checks, mini statements

- Value-add transactions for new revenue streams – airtime top up, bill payments, pre-approved nano loans, remittances, micro insurance, etc.

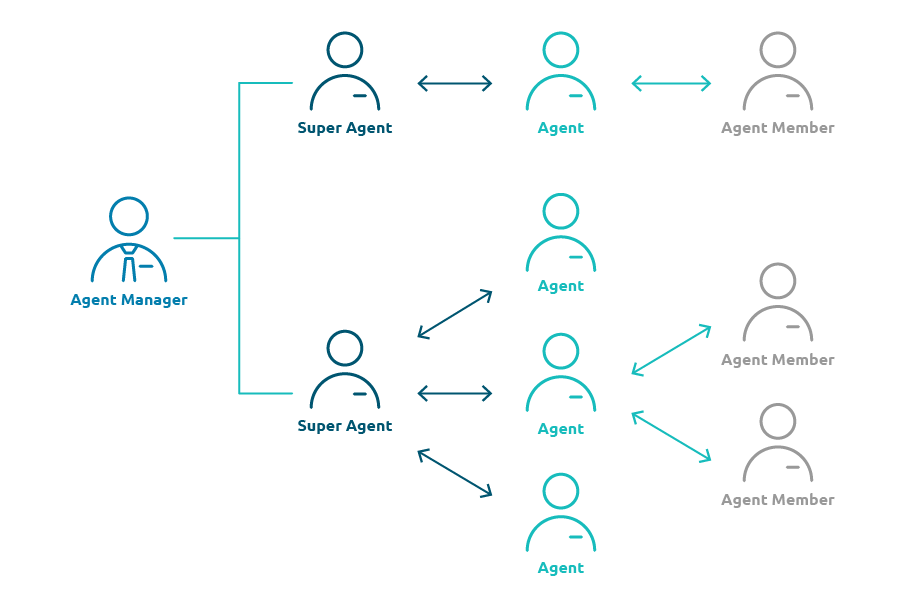

Everything You Need to Grow and Manage a Successful Agent Network

Convert local shops into agents. Manage from a central space.

- Organise with unlimited agent hierarchy and support for agent types, roles, and access levels.

- Scale the network fast by onboarding new agents on the go with secure authentication and geolocation.

- Set up flexible rules for commission sharing, fees and limits. Manage float and liquidity.

- Minimize agent training through intuitive self-service apps with superb UX on smartphones, USSD, POS.

Flexible Approaches Based on Your Needs

AGENCY BANKING 'FAST TRACK'

Pay-per-use/ Revenue-share

If you want to start fast with an affordable, out-of-the-box cloud solution with standard features without investing in IT infrastructure. Let us manage the platform.

FULL-SCALE, TAILORED AGENCY BANKING

License/ Subscription Model

If your business model demands a fully customizable Agency Banking Solution with an entire suite of features and flexible deployment options, all tailored to your needs.

Celent Recognizes Business Intelligence Agency's Agency Banking Expertise

According to Celent, many can learn from Business Intelligence Agency’s experience helping financial institutions foster financial inclusion for the last 10 years. In this brief, Celent’s analysts explore our Agency Banking Solution, acknowledging it as a viable option for financial institutions looking for technology partners.

A Digital Transformation Platform in Action.

Agency Banking is built on DigiWave Platform. Future-proof your digital channel business case.

24/7 SERVICE AVAILABILITY

Excellent reliability in both mature and developing markets. Seamless payment processing with transaction authorization, reconciliation and 24/7 store and forward.

FLEXIBLE ONBOARDING & ORIGINATION FORMS

Easily configure your own forms. Store data on the DigiWave platform or directly in your core banking or other systems.

CONFIGURABLE WORKFLOWS

Customize your own or use out-of-the-box workflows. Benefit from multi-level loan decisions, fueled by data. Digitize, automate and streamline all processes.

CENTRALIZED MANAGEMENT. MULTI-COUNTRY. MULTI-TENANT

Manage all your digital channels from a central administration portal. Leverage on mature agency banking capabilities.

CREDIT SCORING & ADVANCED ANALYTICS

Offer fast track loans to your best customers and nurture the rest. Lower delinquency risk from the start. Identify opportunities through analytics.

CREDIT SCORING & ADVANCED ANALYTICS

Offer fast track loans to your best customers and nurture the rest. Lower delinquency risk from the start. Identify opportunities through analytics.

The Agency Banking Solution at a Glance

1.6 billion people around the world do not have access to basic financial services. In order to scale sustainably, financial service providers need to look beyond costly brick-and-mortar to expand their reach through innovative digital channels.

Why Choose Business Intelligence Agency ?

24/7 SERVICE AVAILABILITY

Agency Banking is built on DigiWave - Enterprise Digital Banking Platform, accelerating your digital transformation.

CONFIGURABLE WORKFLOWS

Customize your own or use out-of-the-box workflows. Benefit from multi-level loan decisions, fueled by data. Digitize, automate and streamline all processes.

CREDIT SCORING & ADVANCED ANALYTICS

Offer fast track loans to your best customers and nurture the rest. Lower delinquency risk from the start. Identify opportunities through analytics.

Empowering the Innovators

Make waves with your digital subsidiary, neo-bank, or greenfield bank built on DigiBank,