Seize the Digital Payments Opportunity with Mobile Wallet

ATTRACT & RETAIN CUSTOMERS IN THE DIGITAL ERA

Increase customer satisfaction with seamless digital payment experiences P2P, in-store, and online.

EXPAND CUSTOMER BASE

Grow your customer base exponentially without investing in costly branch and ATM infrastructure.

REDUCE COSTS

Reduce customer acquisition and transaction costs. Utilise lower electronic money account barriers.

ACCELERATE FINANCIAL INCLUSION

Extend financial services to the bottom of the pyramid via USSD devices.

Enterprise-grade Mobile Wallet Platform

Completely customizable to your business case

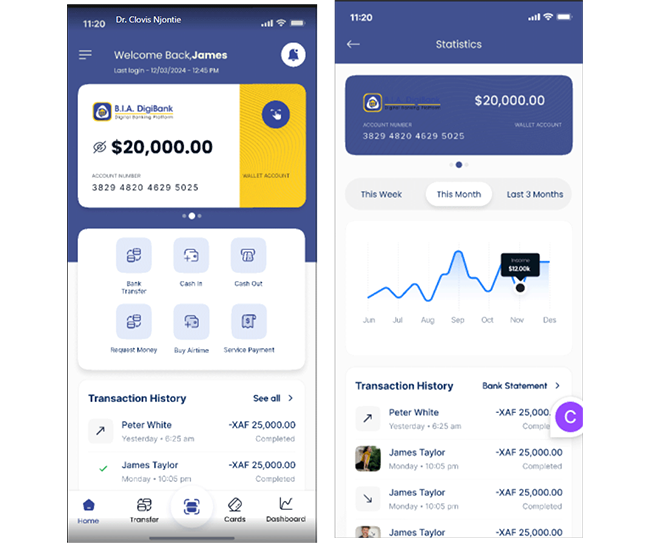

SUPERB EXPERIENCE CUSTOMERS ENJOY

Customer-centric UX end-to-end. Self-onboarding in minutes, saving time from branch visits. Provides users with a transactional account with rich payment instruments and additional services.

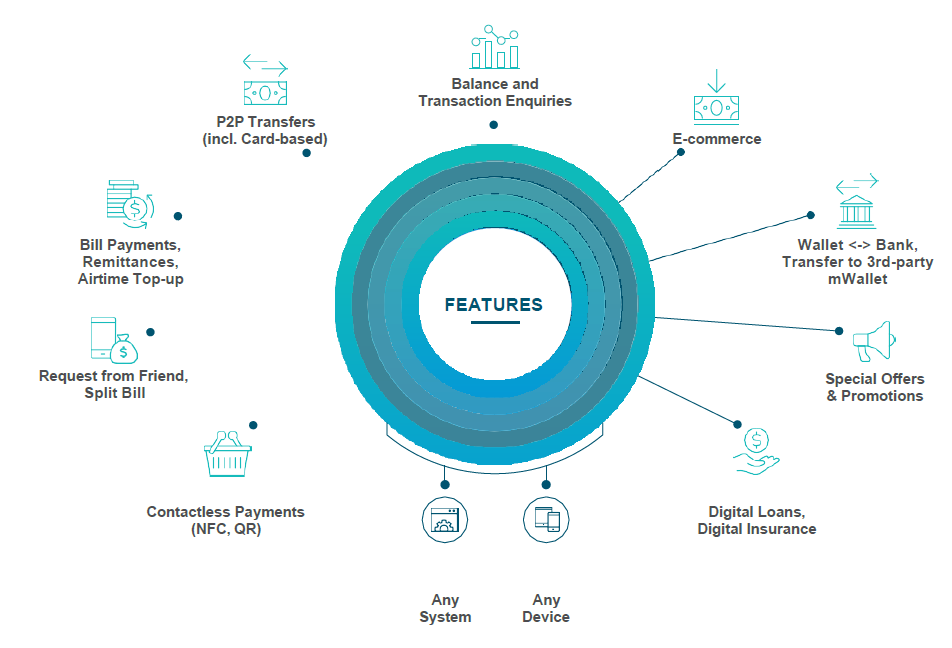

P2P, CONTACTLESS PAYMENTS & MORE

Enables customers to send and receive money instantly P2P, C2B, B2B or G2C. Offers contactless in-store payments with QR or NFC, e-commerce, split-bill, request from friend, cash-out, bank transfers, etc.

VALUE-ADDED SERVICES

Helps you differentiate by aggregating value in your digital ecosystem – insurance, digital loans, savings, bill payments, remittances, rewards, promotions, etc.

SUPERIOR SECURITY

Customer identity verification with flexible KYC, biometrics and more. Provides transaction authentication, encryption, and tokenization of cards and payments.

Supporting Flexible Digital Wallet Models

Empower customers to digitalize their cards for NFC and QR payments in-store, online purchases, P2P transfers, etc. Enable them to store and manage their debit and credit cards, be it from your institution or from other issuers. Issue virtual cards in seconds.

Keep funds in a closed ecosystem to reduce costs and increase convenience. Expand services to more customers via low-KYC accounts. Stored Value Accounts (SVA) maintain a current balance in the wallet and perform instant transfers in a closed-loop system.

Wallet account is stored in the core banking system. The mobile app is the means of onboarding and managing thе account. Leverage the bank's participation in any real-time payment infrastructure, such as the SEPA Credit Transfer Scheme in Europe, for wallet transactions.

Make Your Mobile Wallet Stand Out

Differentiate your offering and succeed with high wallet adoption

Whitepaper: Executive Guide to Digital Wallets - Models and Business Potential

This whitepaper is crafted for business and technical leaders in banking, Fintech and financial services, who are looking for in-depth, expert analysis on the types of e-wallets, use cases and business models available, to guide and inspire their strategic decisions.

Offer a Rich Portfolio of Mobile Financial Services

Go to market fast with exceptional mobile payment experiences, successfully rivaling Fintechs and neobanks.

Retain members through a range of modern digital financial services without replacing costly systems.

Extend financial services to the bottom of the pyramid while improving convenience for customers (for both USSD and smart devices).

Securely onboard beneficiaries and disburse funds in bulk, directly or via agents.

Attract more customers and diversify income by entering into mobile financial services.

Enable self-service transfers for customers via mobile and reduce agent costs.

Whitepaper: 10 Top Business Drivers to Launch a Mobile Wallet

Тhe e-wallet opportunities you can’t afford to miss! From new business models like Marketplace, SuperApp, PaaS, to merchant acquisition, customer engagement, and more. Explore our practical guide for enterprise decision-makers.

Customer Highlights

AB Bank providing all Zambians with easy access to real-time banking services

AB Bank Zambia, a member of Access Microfinance Holding AG, in partnership with Software Group, launched the mobile wallet eTumba. Offering easy self-registration, the innovative technology combines the user-friendliness and convenience of a mobile wallet with the security and reliability of a bank account.

320+ integrations done to build a full payments ecosystem for KICB's Elsom Wallet

To achieve its ambitious goals of providing the people of the Kyrgyz Republic with modern and advanced financial solutions, KICB chose Software Group as the partner that offers a robust and flexible Mobile Wallet platform that adds value and convenience for people, and further allows for the creation of a full payments ecosystem.

Last generation ONE Wallet for Postbank Bulgaria

Based on Business intelligence Agency’s Mobile Wallet platform, ONE wallet is a last generation high-tech application offering convenience, security and excellent control in contactless card payments and money transfers via a smartphone. Some of the wallet’s features include payments via ATM, POS and Internet, fast money transfers between the wallet users, adding loyalty cards through QR code, and more.

New Zealand's first digital wallet Dosh, powered by Software Group

Built on Business intelligence agency’s Mobile Wallet platform, Dosh enables both customers and small businesses to pay and get paid anytime, anywhere. The app comes in two versions: Dosh for Consumers and Dosh for Business. Currently, the company works with all the major banks including BNZ, ASB, Westpac, ANZ and Kiwibank.

MOBILE WALLET

Be a Forerunner in the Digital Payments Ecosystem

Mobile Wallet is an extremely flexible platform which can serve various API-led digital wallet business cases.

From new business models like Marketplaces, multi-tenant Wallet Platforms as a Service, ecosystem-driven Super Apps, to merchant acquisition, and more.

Reinvent your business by becoming a platform provider, a central role which integrates the

A Digital Transformation Platform in Action.

The Mobile Wallet Solution is built on DigiWave Enterprise Digital Banking Platform - the foundation of a future-proof digital journey.

ONE-STOP, FLEXIBLE DIGITAL WALLET PLATFORM

Rich wallet functionality built on a powerful platform that can cater for all your digital financial service needs. Completely customizable to your brand, serving your business case.

CENTRALIZED MANAGEMENT. MULTI-COUNTRY. MULTI-TENANT

Manage all your digital channels from a central administration portal. Customize transaction fees, commissions and rules for your ecosystem.

SEAMLESS INTEGRATIONS

Reuse existing infrastructure and easily integrate with your CBS. Alternatively, use Mobile Wallet as a standalone platform. Connects with any third-party system. PSD2 and GDPR compliant.

FRICTIONLESS 24/7 PAYMENTS ACROSS THE ECOSYSTEM

Faster payments mean more revenue. Handle vast amounts of data and process thousands of transactions per second. Deliver frictionless service in both mature and developing markets.

UX DESIGN EXPERTISE

Leverage Software Group’s UI and UX design team expertise in creating engaging digital financial service journeys, personalised for your end customers.

CONFIGURABLE FORMS AND WORKFLOWS

Easily configure your own forms. Customize your own or use out-of-the box workflows. Digitize, automate and streamline all processes.

The Mobile Wallet Solution at a Glance

Today, it takes customers just a few taps to switch to a new financial service provider. Software Group’s Mobile Wallet helps financial institutions utilize digital opportunities, retain and grow customer base in the digital era.

Why Choose Business Intelligence agency ?

Mobile Wallet is built on DigiWave - Enterprise Digital Banking Platform, enabling your growth in the digital era.

Quick-to-market, scalable implementation with fast positive ROI. Cloud, on-prem or hybrid.

Over 10 years of global experience with 200+ customers in over 70 countries