The Digital Era is Transforming Insurance

Twenty-nine percent of consumers would consider buying insurance from online providers such as Google or Amazon (Accenture).

Seventy-six percent of insurers agree that their competitive advantage will depend on the strength of their partners and ecosystem (Accenture).

The seven largest emerging markets will contribute up to 42 percent of global insurance growth (Swiss Re Institute).

Global Insurance Tech market revenue is expected to reach $1,119.8 million USD by 2023, more than double the value in 2018 (Swiss Re Institute).

Addressing Insurers' Key Challenges

Insurers face evolving risks. Explore how our BI agency analyzes market trends to devise proactive risk mitigation strategies, ensuring stability in volatile markets.

Staying compliant amidst regulatory changes is complex. Explore how our agency utilizes advanced analytics to streamline compliance processes.

Unlock the power of data-driven insights to refine underwriting processes. Discover how our BI solutions provide nuanced analytics and more technologies.

Efficient claims processing is critical. Dive into our BI agency's approach using predictive analytics, enabling insurers to claims.

Tailored BI solutions empower insurers to understand and anticipate customer needs. Learn how our agency crafts customer-centric strategies.

The future demands innovation. Explore how our agency integrates AI-driven solutions, insurers by leveraging technologies .

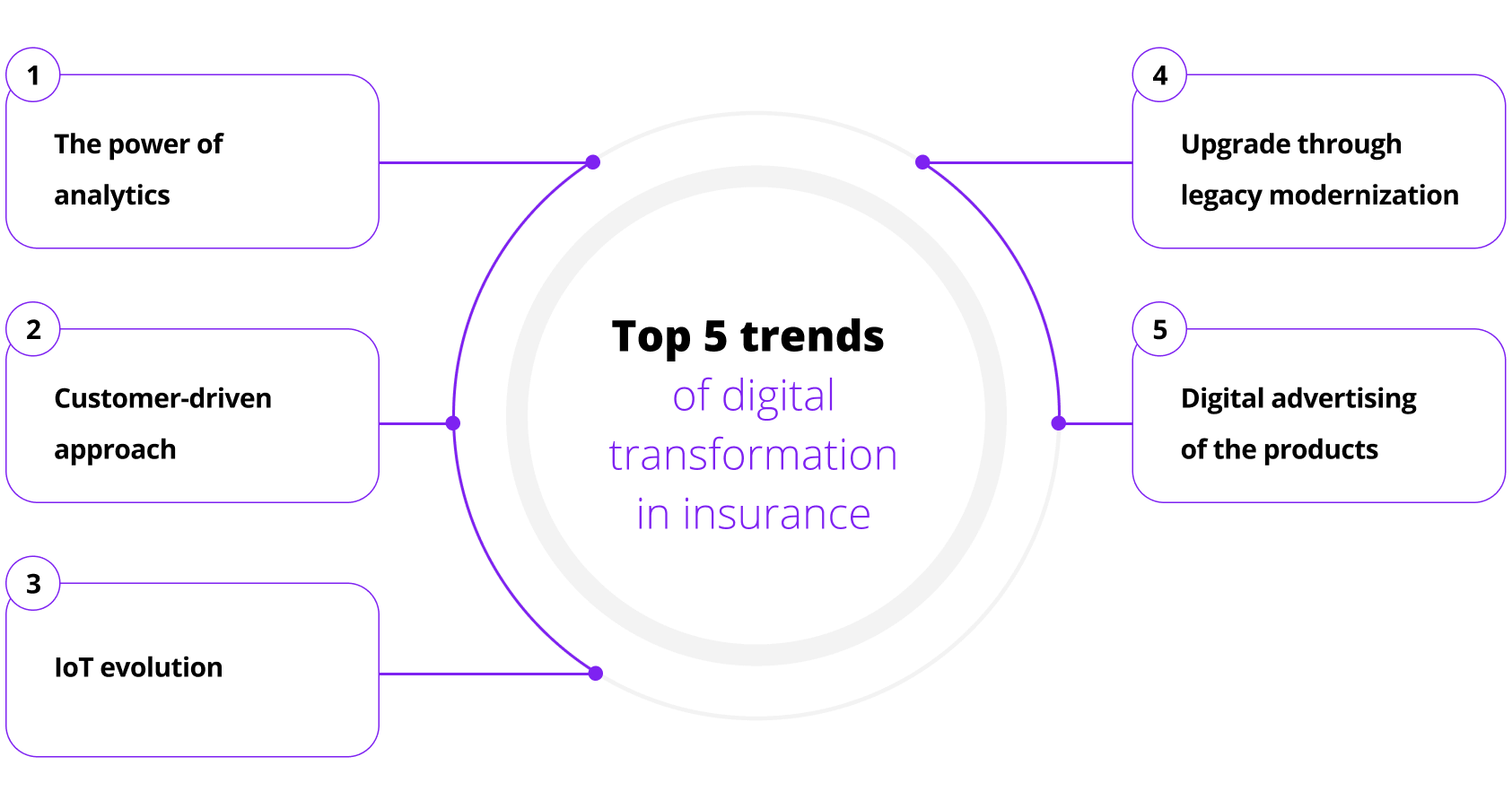

Helping Insurers Win in a Digital-first Market

Business Intelligence Agency's solutions enable insurance companies to embrace digital and grow a profitable business in the new digital insurance ecosystem.

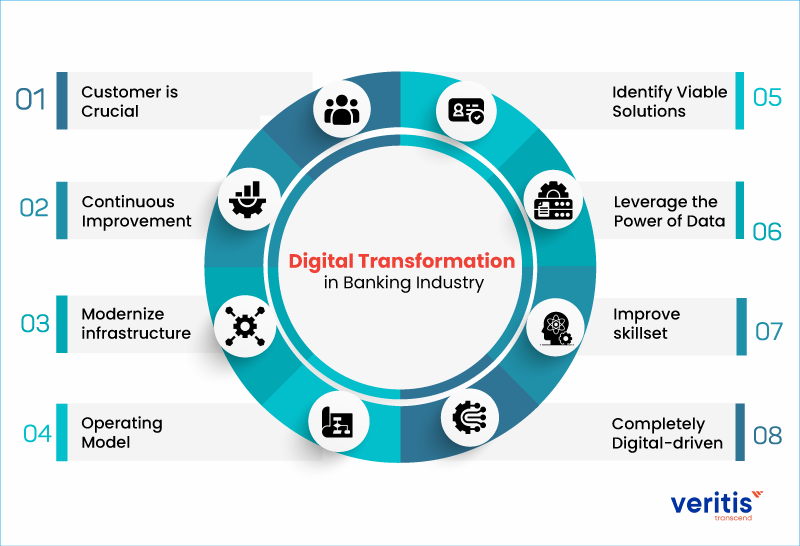

OMNICHANNEL CUSTOMER CENTRICITY

Sell insurance via digital channels, automate claims processing, increase client base and engage customers with seamless onboarding and self-service.

END-TO-END VALUE CREATION

Implement end-to-end digital insurance cycles, based on a modular, scalable and future-proof platform.

FAST GO-TO-MARKET

Easily launch new digital products and adopt innovative technologies (IoT, AI). Be a champion in the connected digital ecosystem.

DIGITAL TRANSFORMATION

Modernize legacy systems, go paperless and digital, reducing risk and decreasing operational costs.

Digitalization Solutions for Insurance

End-to-end Digital Insurance Platform

A unified, customer-centric, omnichannel digital insurance platform. Enables insurers to create compelling digital journeys across channels and ecosystems, transforming onboarding, sales, underwriting, payments and claims processing. Modernizes legacy systems via APIs, integrations and reusable microservices to give insurers the edge and speed they need in the digital era.

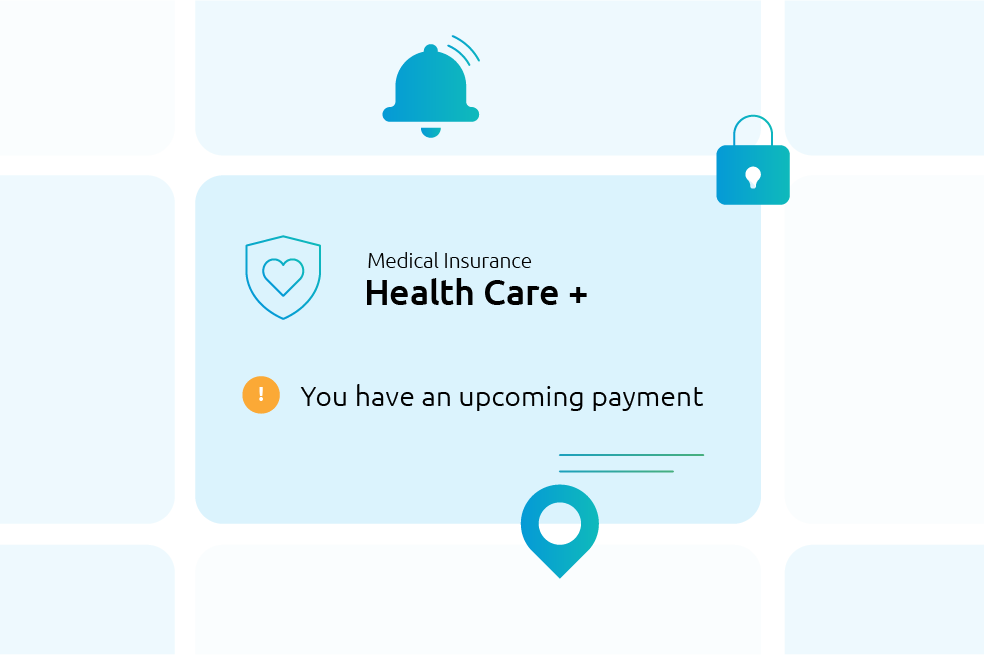

Customer Self-service Portal & Mobile App

Offer the digital experience that keeps customers coming back. Reduce sales and service costs and maximize customer lifetime value in the digital era.

- Interactive quoting and policy sales

- Digital onboarding with e-identification to avoid visiting a branch

- Chatbots with conversational UX to engage customers at scale

- Digitalizes the customer lifecycle end to end – from discovery, through policy purchase, payments, claims, and renewals

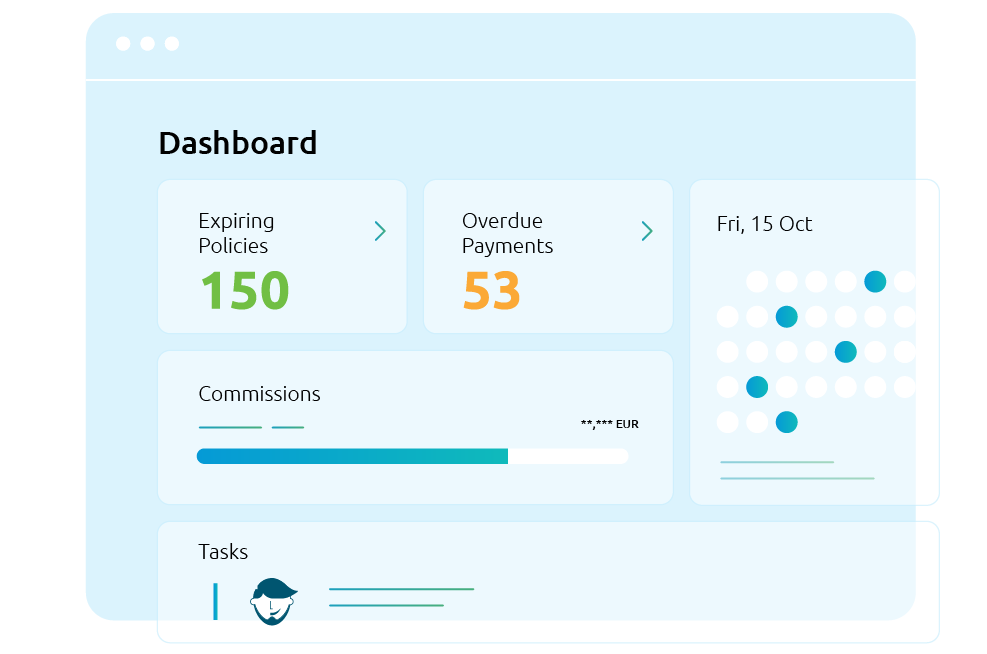

Agent/ Broker Sales Portal

Elevate agents through digital. Remove complexity for your distribution partners and enable them to provide excellent service.

- Agent and broker sales apps

- Quote and Bind tool for agents for policy sales and renewals for multiple lines of business

- Customer 360 approach, easy policy administration

- Home dashboard, alerts and notifications, and more.

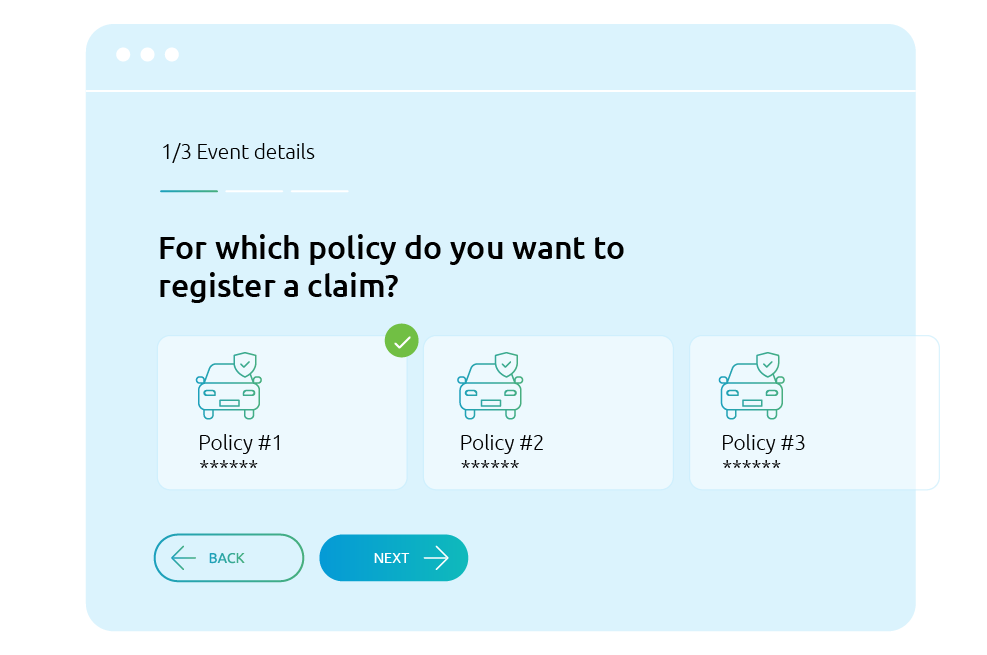

Digital Claims

Win consumer trust and satisfaction with a quick and easy claims submission process & full claim status visibility.

- 20%+ claim cost reduction and faster claims processing

- Easy and convenient first notice of loss submission (FNOL) via an Interactive Guide

- Claim status tracking

- Documents and images submission

- Easy integration with any backend claims management system to provide a modern front end for web/mobile.

Why Choose Business Intelligence Agencie's Digital Insurance Platform?

END-TO-END DIGITALIZATION OF GENERAL INSURANCE LIFECYCLE

Covers all stages and ecosystem players in the general insurance sales and claims management value chain.

FLEXIBLE DIGITAL PRODUCTS CREATION

Create customized sales products for multiple lines of business. Easily configure tariffs and workflows.

ENTERPRISE INTEGRATION PLATFORM

Modernize legacy infrastructure. Connect any core or external system. Capture the value of APIs.

FUTURE-PROOF AND ECOSYSTEM-READY

Secure your digital roadmap with the platform’s scalability, based on microservices and reusable modules.

SECURITY, AML & FRAUD MANAGEMENT

Provides industry-standard security with SSL support and end-to end encryption of customer data.

CENTRALIZED MANAGEMENT. MULTI-TENANT.

Manage all your digital channels from a central administration portal. Define flexible user roles, permissions, tasks.

Ready to take your insurance business to the next level?