Addressing MFIs' Key Challenges

Business intelligence Agency supports digitalization in 7 out of the 10 biggest MFI networks around the globe.

Long, manual, paper-based, error-prone processes lead to high distribution costs and slow loan turnaround times.

Lack of data to inform credit decisions result in higher loan delinquency and poor portfolio quality.

Aggressive competition from FinTechs and telcos threatens market share.

Dispersed customer base and low transaction values result in high costs per transaction and limit the ability to scale.

Inefficient back-and-forth visits and congested branches cause poor customer experience.

Limited digitalization leads to slow go-to-market and operational inefficiencies.

Helping MFIs Go through Digital Transformation

Accelerating Financial Inclusion

INCREASE OUTREACH THROUGH DIGITAL CHANNELS

Digitalize traditional distribution channels, such as branches, field services and agency banking. Expand into remote, underserved markets at a minimal cost.

DIGITIZE OPERATIONS TO ACHIEVE EFFICIENCY

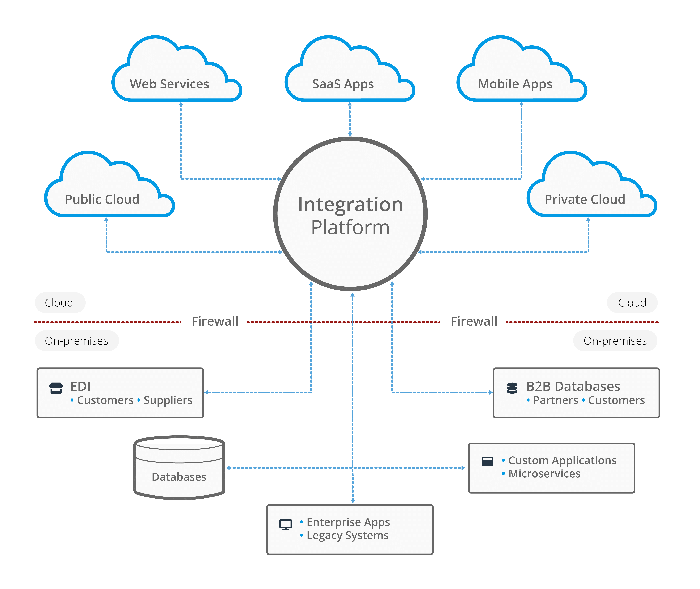

Reduce paper-based processes. Improve data quality and speed through real-time integrations (credit bureaus, scoring, identity, etc.

DELIVER CUSTOMER-CENTRIC PRODUCTS

Acquire customers anywhere with remote customer onboarding and loan origination for both individual and group lending products and processes. Personalize offerings based on data to improve portfolio quality.

Whitepaper: Field Staff Digitalization in Microfinance

Led by microservices and APIs, DigiBank comes with configurable digital banking capabilities, such as onboarding & origination, multi-factor authentication, identity management, forms, workflows, payments, integrations, chatbots and more. Deployable on premise or in the cloud. Easy to integrate with any core banking system.

Agency Banking Solution

Accelerate financial inclusion in remote, underserved markets through a cost-efficient network of 3rd-party agents, serving customers on your behalf.

Mobilize more deposits through agents, offer value-added services, such as prequalified nano loans. Leverage everything you need to grow and manage a successful agent network – advanced agent analytics, hierarchies, etc.

Digitalization Solutions for Microfinance

Leverage Business Intelligence Agency's platform and digital channel solutions for an end-to-end approach to financial service distribution

Digital Field Application

A leading solution for Remote Customer Onboarding, Account Opening, Loan Origination, Group Lending, Savings and More

Dramatically improves field officer productivity, portfolio quality & operational efficiency. Reduces paper and decreases field service costs.

Mobile Wallet Solution

Extend financial services to the bottom of the pyramid at a low cost (for both USSD and smart devices).

Enterprise Integration Platform

Build and orchestrate a connected digital business, ready to move fast.

Microfinance Solutions Powered by a Digital Banking Platform

Take a future-proof approach to digital transformation, based on a platform. Modernize legacy systems, processes, products, channels and customer engagement with DigiBank Enterprise Digital Banking Platform.

Why MFIs Partner with Business Intelligence Agency

Michael S. - Tech Enthusiast

As a tech-savvy individual, I appreciate innovation, and digital banking blew me away. The ability to control finances from my smartphone, instant notifications for transactions, and intelligent budgeting tools have made my financial life organized and stress-free."

Katherine R. - Entrepreneur

"Switching to digital banking transformed my business operations. With seamless transactions, real-time insights, and secure payment options, managing finances became a breeze."

Sophia L. - Busy Professional

"Managing my finances was a headache until I embraced digital banking. Paying bills, transferring funds, and even investing are now effortless. The secure platform and 24/7 access cater perfectly to my busy lifestyle."

David M. - Frequent Traveler

"Being on the move constantly, I needed a banking solution that traveled with me. Digital banking provided that and more. No matter where I am, I can track expenses, access account details, and even apply for services."

Emma H. - Student

"Digital banking made managing my student finances a breeze. From splitting bills with roommates to tracking spending habits, it's an essential tool for financial independence. "

Ready to accelerate your digital transformation journey?