Helping Banks Lead in the Digital Era

Platform-driven digital transformation

Innovate without replacing costly systems and easily scale beyond your core. Streamline processes to boost operational efficiency.

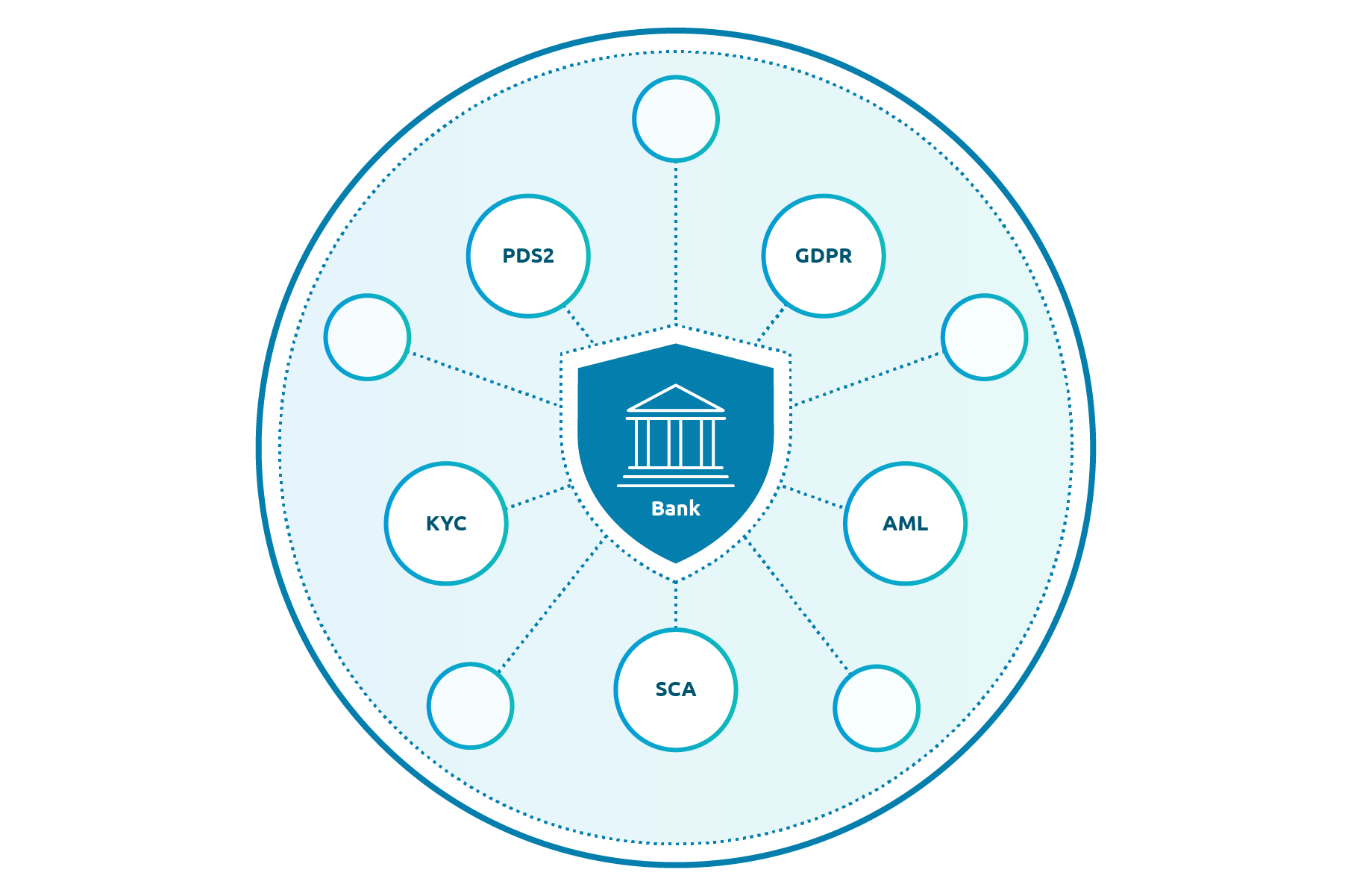

Compliance excellence in a digital world

Integrate any regulation or risk requirement end-to-end across process workflows (PSD2, GDPR, AML, FATCA, etc.)

Rapid innovation

Win in the digital race with a modular and scalable digital banking platform, supporting your digital growth ambitions.

Fast time to market with digital initiatives

Quickly launch new digital products and services. Start fast with what you need and scale as you grow. Adopt new technologies with ease.

Omni-channel customer centricity

Rethink the ways customers interact with you across channels. Become your customer’s “everyday bank”, exceeding expectations.

Open banking realized

Monetize the open banking opportunity. Integrate with your value-chain partners to create customer value and unlock new revenue streams.

End-to-end Digital Banking Solutions

Built on a single, mature and future-proof platform, enabling quick time to market, easy scaling, and cross-channel workflows.

At vero eos et accusamus etiusto odio praesentium accusamus etiusto.

Rich wallet functionality built on a powerful platform that can cater for all.

Digital bank proposition, backed by an end-to-end digital banking platform.

Self-service banking on any device that meets customer expectations.

A groundbreaking mobile factoring solution that brings together all the parties.

Over 10 years of experience. Built on our mature Business Intelligence Agency.

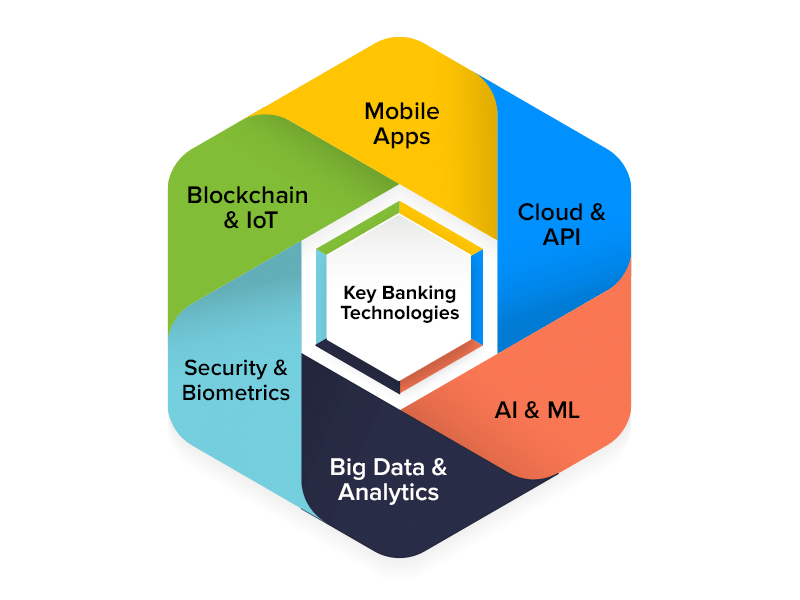

Powered by DigiBank Business Intelligence Agency

Led by microservices and APIs, DigiBank comes with configurable digital banking capabilities, such as onboarding & origination, multi-factor authentication, identity management, forms, workflows, payments, integrations, chatbots and more. Deployable on premise or in the cloud. Easy to integrate with any core banking system.

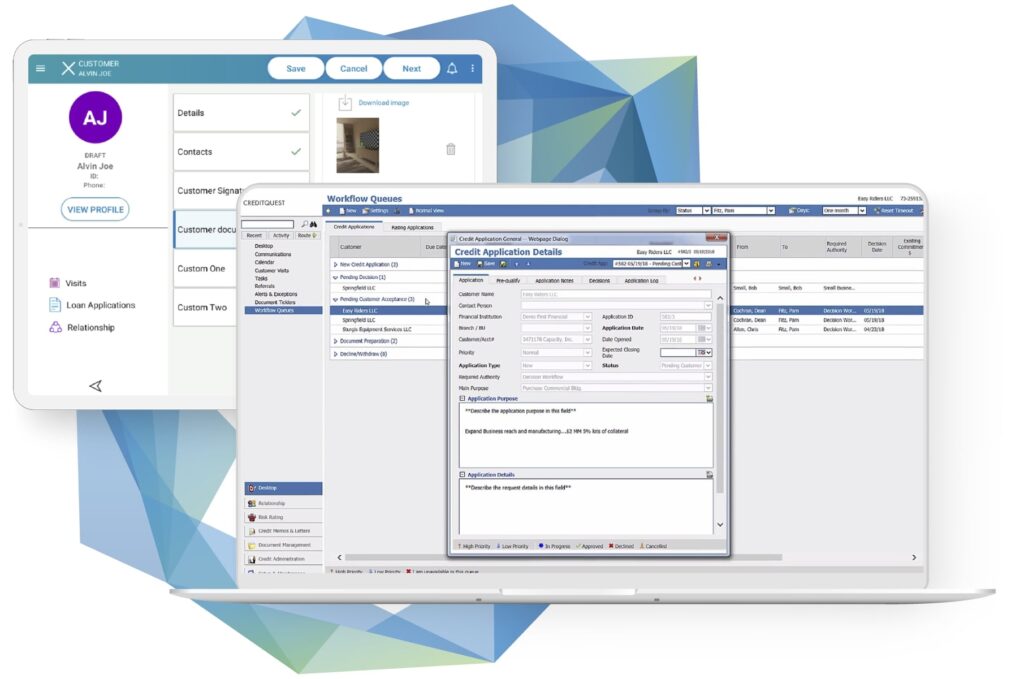

In Focus: CreditQuest Loan Origination Solution

Streamline the credit process, manage credit and operational risk and grow a profitable loan portfolio.

Trusted by leading organizations across the globe, CreditQuest delivers real results for bank teams from application to disbursement.

A single solution for commercial and retail loan origination, risk ratings, advanced analysis, underwriting, documentation, executive reporting, and portfolio management with a focus on the customer relationship.

Inclusive Finance Solutions

Extend your offering to underserved or unbanked segments through cost-efficient branchless banking channels. Mobilize deposits and deliver convenient services in previously untapped markets.

Deliver differentiated, cost-efficient doorstep banking services.

Provide convenient, low-cost banking and value-added services to mobile customers.

"Our priority is to offer our clients contemporary digitalized customer service with a focus on speed, quality and individual approach. The implementation of the new digital platform along with Software Group is part of our strategy for digital transformation and will ensure new and improved customer experience."

Georgi Zamanov, CEO Allianz Bank Bulgaria

Achieve Compliance Excellence in a Digital-first World

- Centralize customer data across systems, facilitating data governance in accordance with regulations (such as the GDPR).

- Integrate with third parties to ensure compliance in areas, such as AML, embargo sanction lists, FATCA compliance, etc.

- Meet Know Your Customer (KYC) requirements through secure Authentication & Identity Management

- Flexibly integrate any regulation and risk requirement starting from onboarding and origination through to servicing processes through DigiWave’s strong Workflow, Task and Document Management

- Comply with PSD2 with Strong Customer Authentication (SCA) and Consent Management

- Control 3rd-party relationships with advanced API capabilities, and more.

What is the next initiative on your bank's digital agenda?